Ubank takes the reins of neobank 86 400, reveals new look and products

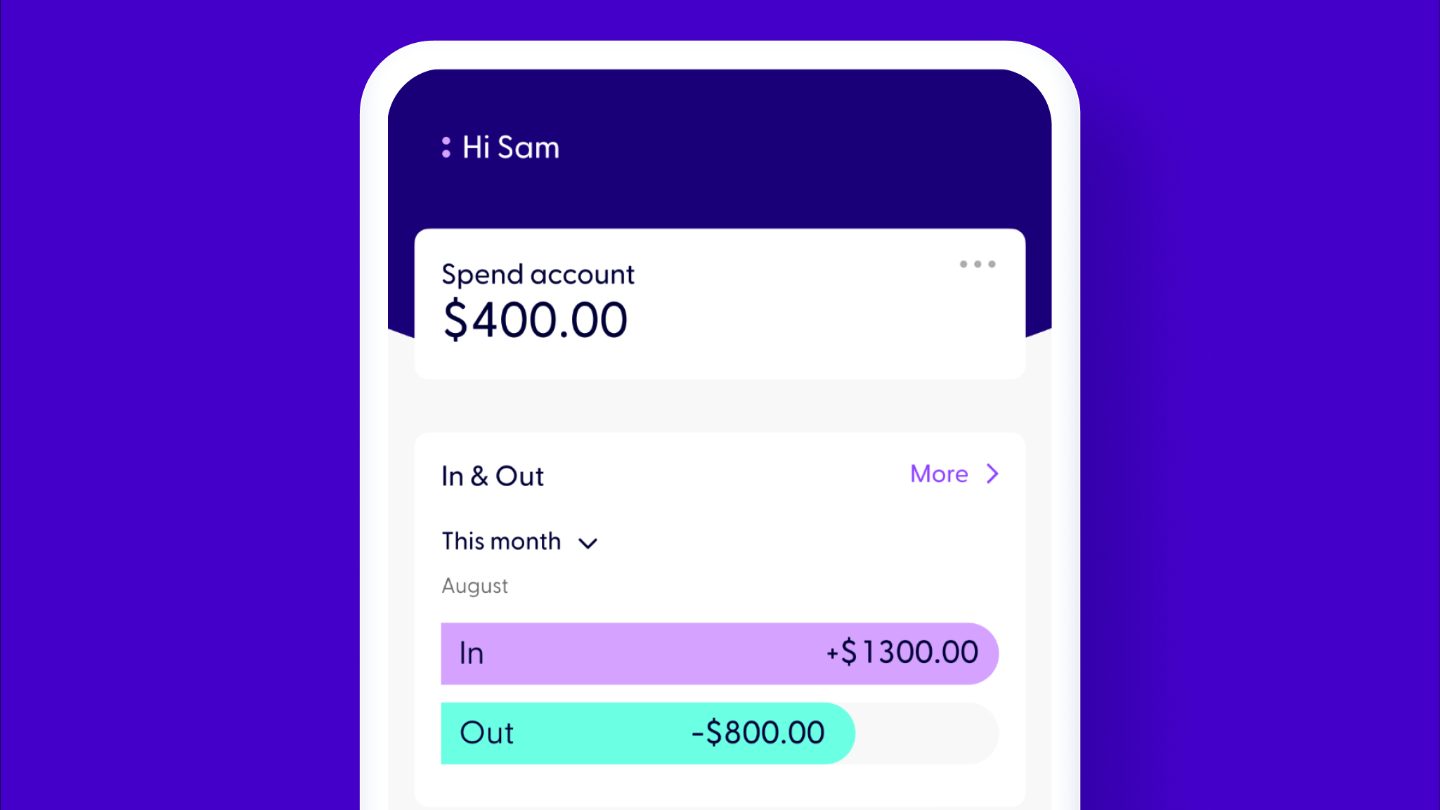

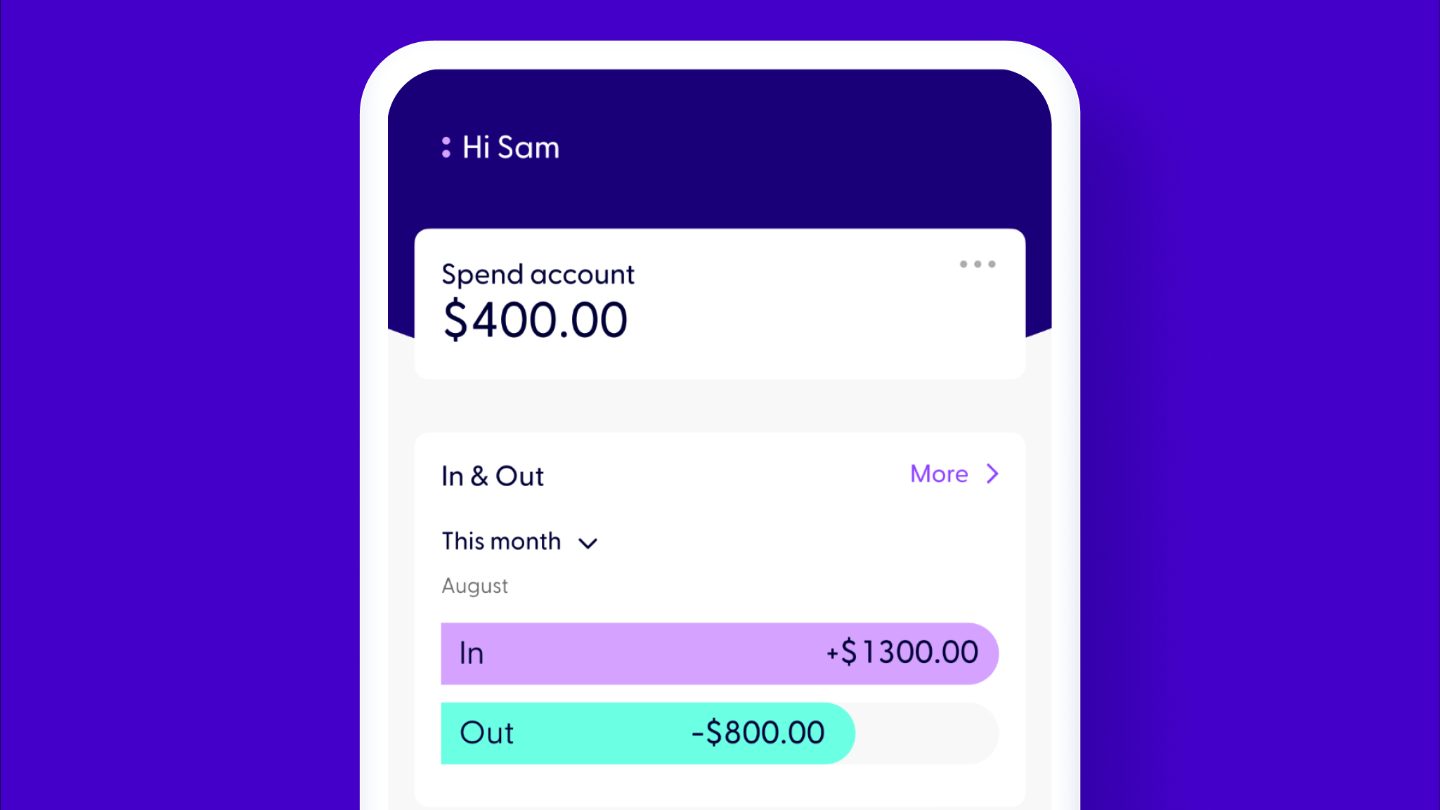

Ubank, an Australian direct bank owned by National Australia Bank (NAB), today unveiled a new look following their absorption of neobank 86 400.

Read More

Ubank, an Australian direct bank owned by National Australia Bank (NAB), today unveiled a new look following their absorption of neobank 86 400.

Read More

Wherever you look you’ll find that the median house price in most Australian capital cities has moved closer to one million dollars.

Read More

Many Australians are focussing on reducing household costs right now, and saving on interest repayments by switching to a better value home loan or personal loan is a great place to start.

Read More

To ease the inflation currently bearing down on the economy, the Reserve Bank of Australia (RBA) has finally begun tightening monetary policy, lifting the official cash rate by increments of 25-50 basis points over the last three months.

Read More

Mortgage repayments are the biggest household expense for many Australians, and also a prime target for big potential savings, especially now that interest rates are on rise.

Read More

Alongside another unseasonable spate of rainfall, the flash-hot Australian housing sector has experienced a week of cooling off.

Read More

With Australian homes producing 13% of the country’s greenhouse gas emissions, it’s no surprise that Aussies are keen to find greener options for their property and finances.

Read More

The Reserve Bank of Australia (RBA) has responded swiftly to soaring economic inflation, hiking the official cash rate 0.75% in the last two months alone. The movements brought interest rates back up to pre-pandemic levels and spelled much anxiety for home loan borrowers, many of whom were already feeling the squeeze from the rising cost of living.

Read More

The pandemic’s influence on the property market is being felt in more ways than one, shows a new report from Domain on the NSW housing market.

Read More

NSW Premier Dominic Perrottet has confirmed that eligible first-time borrowers will have the option of paying stamp duty or an annual land tax, starting 16 January, 2023.

Read More